|

|

|

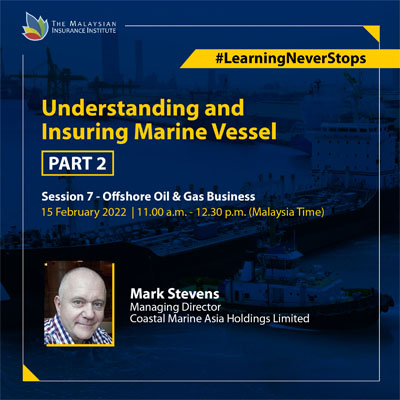

Understanding and Insuring Marine Vessel Part 2

Session 7 - Offshore Oil & Gas Business

15 February 2022, 11.00 a.m. - 12.30 p.m.

This is the final session in the series where the presenter will focus on offshore oil and gas business. In this session the will talk about the drilling contractor’s equipment, namely the Jack-up drilling rig, the Semi-submersible drilling rig, and the Drillship; explaining how each of the vessels operates and how they differ in their method, capability, cost, and mobility.

Click HERE for more details. |

|

|

Scan the QR code or click HERE to view our

Virtual Learning

Classes Microsite |

Scan the QR code or click HERE to view our

Webinar Microsite |

|

Virtual event. Live broadcast.

|

Industry Workshop on General and Life Insurance 101

Click here for more details |

|

Insurance Innovation Hackathon

In an effort to spur innovation and adoption of technology within the Malaysian insurance industry, The Malaysian Insurance Institute in collaborating with FortNynja will be hosting the Insurance Innovation Hackathon. The aim of the hackathon is to:

-

Generate ideas, MVP (minimum viable product), start-ups and projects that solves key pain points within the industry.

-

Raise awareness on problem statements in the insurance/takaful industry.

-

Promote collaborations between stakeholders, consumers, regulatory, industry, academics, and investors.

Click HERE for more details. |

|

Depreciation in Business Interruption Claims

Singapore Insurance Institute will be organizing a session that focuses on disagreement on treatment on depreciation in a business interruption claim, when a fixed asset is damaged or destroyed.

Join Sam Jenks, Senior Manager from Baker Tilly’s Global Forensic, Singapore, in “Depreciation in Business Interruption Claims” on 25 February 2022 at 11.00 a.m. (SGT).

Click HERE for more details. |

|

|

Extension to September 2023 Examination session for

candidates to transition from DMII or AMII to AMII Level 1 or AMII Level 2

GOOD NEWS for all students who registered for DMII or AMII before August 2016, who have not yet completed the programme!

MII has extended the examination session to September 2023 for all DMII and AMII students registered before August 2016, to complete their programmes under the DMII/AMII framework completion requirements.

REGISTER NOW to continue and complete your DMII/AMII programme. The February 2022 intake is open till 16 February 2022.

For further details, please contact our Programme Adviser or email exammgt@mii.org.my for your

Learning Statement.

Programme Advisor: Ashraff Mohd Rasol 012-210 0465 / Azean Arifin 017-649 2510 /

Santhi Mogan 012-652 3934

|

In conjunction with our move to the new office on Level 6 of Bangunan AICB, we will be conducting our Computer Based Examination (CBE) at Level M of Bangunan AICB from 9 January 2022 onwards.

Check out the latest exam calendar at this LINK |

To cater to those who could not attend our webinar sessions, we have made the recorded versions available for on-demand purchase at MII’s Publications Portal. There’s more good news – purchased videos have no validity period. This means you can watch it whenever you want!

To start shopping and learning, click on this link or scan the QR code below:

For any inquiries, please email us at events@mii.org.my.

Dear MII valued members and customers,

Please be informed that The Malaysian Insurance Institute (“MII”) is conducting a Customer Satisfaction Survey from 3rd December 2021 to 31st December 2021. To ensure the integrity of this survey, we have commissioned Metrix Research (“Metrix”) to carry out this exercise.

As MII strives to improve its products and provide effective support to the industry, we are committed to measure progress against our Vision, Mission and Critical Success Factors. The results of this survey provide valuable information about the effectiveness of MII’s work and form the basis for action points to shape the future of MII’s work.

Metrix will contact customers directly for feedback and the selection of our customers for this survey is conducted

randomly by Metrix.

Please be assured that all responses will be treated in the strictest confidence. Should you have any queries pertaining to this survey, kindly contact our customer service representatives at customercare@mii.org.my and +603 2712 8882.

We thank you for your continuous support of MII.

|

|

Official Opening of February Intake Enrolment for CMII and AMII.

Closing date: 16 February 2022

The Public Virtual Class Schedule for the respective subjects are available for viewing.

Please click below link to access the site.

|

Fellowship of The Malaysian Insurance Institute (FMII)

Looking forward to move towards the highest professional qualification?

Join us to know more about the Fellowship programme to achieve greater heights in your insurance career! - The MII Fellowship programme is designed to assist insurance practitioners across all sectors of the insurance and takaful industry to enhance their career prospects.

-

It is the culmination of a structured learning programme after completion of the Associateship of The Malaysian Insurance Institute (AMII).

-

It includes planned acquisition of skills and knowledge which will form an integral part of the personal and professional development programme.

Click HERE to learn more about MII’s Fellowship Programme. |

|

Check out MII’s Customised Training!

Customised training is often associated with higher spending budget. However, taking a one-size-fits-all approach to training may not ultimately meet business goals.

At MII, we work closely with our clients to develop targeted and relevant training content specially designed to meet our client’s unique business needs. We also deliver customised programmes at a time and location that suits our clients, which is a cost-effective way to train groups of staff and enhances the learning experience.

Click HERE to learn more about MII’s Customised Training.

|

|

Become an MII Member

Be part of us!

As an MII member, you will be given special access to industry updates, MII promotions and upcoming activities. We keep you ahead of the rest.

Click HERE to learn more about MII Membership. |

Check your Membership Status

Click HERE to check your status. |

|

New Membership Categories for MII Qualified Members!

In recognition of member qualifications and commitment towards professional excellence in the industry, we have revised the criteria for Individual Membership categories as follows:

|

|

|

| CertMII : A holder of MII professional certification (CMII-General, CMII-Life, Professional Certificate in General Insurance Underwriting, etc) is eligible to apply or upgrade to the new category, MII Certificate member which come with post nominal designation, CertMII. |

AMII : A holder of AMII Level 1 or DMII (old framework) is eligible to apply or upgrade to the category, MII Associate member which come with post nominal designation, AMII. |

SnrAMII : A holder of AMII Level 2 or AMII (old framework) is eligible to apply or upgrade to the new category, MII Senior Associate member which come with post nominal designation, SnrAMII. |

All the above categories will qualify for a digital badge for you to display your post-nominals, competencies and announce achievements online.

Click HERE to see other recognised qualifications for each category and apply for your membership accordingly.

Note: Recognition of these new qualifications is solely for membership purpose only and there will be no changes to the qualification awarded.

MII-ANZIIF Dual Membership

Qualified MII members can apply for the dual MII-ANZIIF membership as follows:

| MII Professional Qualification |

MII Membership |

ANZIIF Membership |

Membership Fee Bundled |

| Fellowship of MII | MII Fellow |

Fellow CIP |

AUD450 (save AUD 225) |

| Associateship of MII Level 2 / AMII | MII Senior Associate |

Senior Associate CIP |

AUD400 (save AUD 200) |

| Associateship of MII Level 1 / DMII | MII Associate |

Associate CIP |

AUD380 (save AUD 190) |

Existing MII members can apply/renew as ANZIIF member at AUD350 under this dual membership program.

Click HERE for more information on ELIGIBILITY, BENEFITS and HOW TO REGISTER for the dual membership now.

|

Exclusive Member Benefits

Enjoy exclusive benefits of being a professional member of the insurance industry and get the recognition, opportunity and support from the membership fraternity.

Discover the FULL LIST to check your status.

|

|

| |

|

|

|

Activate MII Rewards

MII Rewards is a new initiative by The Malaysian Insurance Institute (MII) to recognize members for their support and loyalty, exclusively for MII Fellow, Senior Associate, Associate & Certificate members. Click HERE to know how you can start to enjoy this benefit.

As part of our initiative to address the demand of professional membership in the insurance industry, we are happy to announce that MII now has recognise the CII qualifications as an alternative prescribed examination for admission as an MII member as follows:

| MII Membership |

Prescribed MII Qualification |

Recognised CII Qualification |

| Fellow | Fellowship of MII |

Fellowship of CII |

| Senior Associate | Associateship of MII Level 2 / AMII |

Advance Diploma in Insurance (ACII) |

| Associate | Associateship of MII Level 1 / DMII |

Diploma in Insurance (Dip CII) |

Starting from January 2022, a person who holds ACII / Dip CII and wishes to apply for Associate / Senior Associate member of MII, must fulfill these criteria and submit to MII (via email to membership@mii.org.my) for application consideration:

| Malaysian |

Non- Malaysian Residing/Working In Malaysia |

Non- Malaysian Not Residing/Working In Malaysia |

- Register and pay required membership fees,

-

Pay a processing fee of RM200,

-

Submit CV,

-

Provide employer reference.

| - Register and pay required membership fees,

- Pay a processing fee of RM200,

-

Submit CV,

-

Provide employer reference,

-

Provide a proposer and seconder who are either MII Senior Associate or Fellow member,

-

Currently working in /servicing Malaysia or having experience servicing Malaysia for at least 1 year (this can be demonstrated via the CV submitted).

|

- Register and pay required membership fees,

-

Pay a processing fee of RM400,

-

Submit CV,

-

Provide employer reference,

-

Provide a proposer and seconder who are either MII Senior Associate or Fellow member,

-

Provide reason for applying to become an MII member.

|

|

Basic Certificate Course in

Insurance Loss Adjusting (BCCILA)

Date: 21 – 24 February &

28 February – 2 March 2022

For further information: Click here |

Basic Certificate Course In

Insurance and Takaful Broking (BCCITB)

Date: 7 March – 1 April 2022

For further information: Click here |

|

|

3 Tensions Leaders Need to Manage in the Hybrid Workplace

As hybrid work transitions from a temporary pandemic-era band-aid to the normal way of working, many leaders are wondering how they build an inclusive hybrid culture.

Read More

|

|

3 Strategies for Holding Yourself Accountable

At the beginning of your career, you were bright-eyed and bushy-tailed. You asked for help and soaked up the wisdom of your mentors and managers to climb the mountain.

Read More

|

|

Lessons on Success: 3 Reasons Why Failing is Good

Success is good but failure is better. You must not let successes get to your head but also must not let failure consume your heart. Know that, sometimes, actually most times, things don’t go as planned and that is perfectly fine.

Read More

|

|

Stress: 10 Ways to Ease Stress

Stress serves an important purpose—it enables us to respond quickly to threats and avoid danger. However, lengthy exposure to stress may lead to mental health difficulties (for example, anxiety and depression) or increased physical health problems.

Read More

|

Japan's Largest Bookstore Chain Tsutaya Will Open Its 1st Outlet In Malaysia This April

According to BusinessToday, GOB Oriental Berhad along with Sojitz Corporation and Culture Convenience Club are working together to open the new outlet in Pavilion Bukit Jalil this April.

Aside from books, Tsutaya is known as a multi-concept store with a cafe and art display, among other things

Read more

Singapore:MAS-led consortium publishes assessment methodologies for responsible use of AI

The Monetary Authority of Singapore (MAS) has released five white papers detailing assessment methodologies for the Fairness, Ethics, Accountability and Transparency (FEAT) principles, to guide the responsible use of AI by financial institutions (FIs).

The white papers were published by the Veritas Consortium, comprising 27 industry players, including insurers and reinsurers.

Read more |

|

|

|

|

MII Microlearning Modules

On-demand learning through bite-sized Online Learning Content (OLC) is now available as microlearning modules! You can allocate a fraction of your time in your busy schedule to learn something new every day.

To subscribe to MII Microlearning Modules, go to MII iLMS. Watch this video Microlearning Subscription to know how to subscribe.

To find out more about MII Microlearning Module, visit MII Website or email your interest and inquiries to sales@mii.org.my.

|

e-MACC Section 17A Online Learning Content (OLC)

This module is designed to give you a solid understanding of the various concepts of bribery, corruption, and gratification in the Malaysian and insurance context. You will also learn about corporate liability provisions and types of offences and penalties provided under Section 17A.

To find out more ab out the module, click on this link or click here for the subscription manual.

Special Offer

Be one of the first 100 subscribers to enjoy a discounted subscription fee of only RM50* per subscription!

*Applicable to both Individual Subscription and Group Subscription. |

|

|

London School of Sales (LSOS) Modules

In collaboration with the London School of Sales, we offer specialized e-learning modules in essential sales skills, sales management, and leadership techniques that will transform the way you sell. The two LSOS modules offered are: -

Essential Sales Skills

-

Sales Management Toolkit (SMT)

To find out more about MII Microlearning Module, go to https://www.insurance.com.my/LSOS or email your interest and inquiries to sales@mii.org.my. |

MII in collaboration with AIHR Academy

Through our partnership with AIHR we want to empower our members to learn the latest HR skills and lead the charge into 2022!

Information about these programmes is available at our AIHR dedicated webpage on MII’s website. |

Online Learning Content (OLC) Development Services

As new technologies emerge and current technologies evolve, so do the way people learn. Companies are required to keep up with these changes to effectively build, cultivate, and maintain a learning environment that is conducive for the workforce.

Since 2015, MII has established our very own inhouse e-Learning Team to cater to the learning needs of professionals in the insurance industry and beyond. This includes development of new and customised learning content in the form of OLC, conversion of existing and traditional learning content into OLC, and other e-Learning development consultation services such as Instructional Design services.

Why choose MII e-Learning development services? -

Fully-inhouse e-Learning development team

Development experience for over 100 insurance-specific e-Learning content

-

Owner of the largest insurance library in the Asian region

-

Supported by a pool of insurance Subject Matter Expert (SME)

-

Hosting service on MII’s Integrated Learning Management System (iLMS)

For more information on MII’s e-Learning Development Services, email us at elearning@mii.org.my.

Request for a free 5-day trial access HERE.

|

MII Online Learning Content (OLC)

Customer Experience Survey

Your feedback matters!

A million thanks to all our e-Learning subscribers! For continuous improvement of our e-Learning products and services, we actively collect feedback to improve our content development and provide our subscribers with the best possible learning experience.

Just click HERE to complete this quick and simple survey.

Thank you for your support! |

|

| |

|

|

Practice Examination

To help exam candidates prepare for the agents’ licensing examinations, we offer different types of practice questions via our Integrated Learning Management System (iLMS). MII’s Practice Examinations questions are developed to the same quality standards as real examination questions and will provide candidates with: -

a realistic reflection of your level of understanding.

-

a better idea on what topics to focus more on during your revision exercise.

-

experience of the actual exam duration, so you know how much time you really have, to answer all questions.

-

online accessibility, anytime and anywhere.

Click HERE for more details.

All MII Examinations are now conducted online

As the industry’s preferred examination facilitator and in efforts to cater to the current needs of our customers locally and internationally, MII conducts all its examinations fully online via two modes:

|

|

Computer-Based Examination (CBE)

CBE sessions are conducted at selected computer lab facilities throughout West Malaysia and East Malaysia. At these facilities, candidates can sit for examinations without having to worry about technical requirements and connectivity. The facilities are well-equipped with computers and an integrated exam system to ensure seamless and stress-free experience for all candidates. For the full listing on our CBE Centres, click HERE.

|

|

Virtual Computer-Based Examination (VCBE)

VCBE sessions are conducted online using video technology on digital platforms with remote live invigilation. The VCBE is a convenient and a safe option for those who wish to sit for examinations at the comforts of their home. For more details on VCBE requirements, guides and how to register, click on this LINK.

|

Click HERE to see the

2022 Academic and Exam Calendar

|

|

|

|

|

Now available!

Issue 56:

Everyone Matters in Diversity & Inclusion

The conversation surrounding Diversity and Inclusion certainly raises a lot of questions. So where do issues related to Diversity and Inclusion stand today? How have companies made changes to address these issues? Where are we seeing progress and where are there still inequities to be addressed? What’s more, how has the pandemic set us back when it comes to Diversity and Inclusion efforts?

While leadership support is a critical factor, building diverse, authentic relationships that create empathy is a worthwhile investment that takes time. This is something all of us can do every day – no matter how small the initiative – to appreciate diversity and inclusion. An important step towards a more equitable and representative workplace is to go beyond learning and instead, to listen and act. Simple steps to better understand what drives the people we connect with every day goes a long way toward creating an environment where all of us feel that we belong. This is an essential part of business growth that intends to serve people from diverse backgrounds and needs.

Specially for all our Newsweekly readers, here’s a FREE & FULL article from Issue 56 titled "From Intention to Reality – Creating Diversity and Inclusion in Insurance" for your reading pleasure!

Complimentary access to the full Issue is now available at https://miipublications.com.my/ for all MII Members. |

|

|

All MII Members get complimentary access to MII’s quarterly INSURANCE e-Magazine.

To become a member, click HERE.

Alternatively, you can subscribe to the e-INSURANCE Magazine HERE. |

|

|

Purchase MII textbooks and e-books HERE!

Head over to our e-shop NOW while stocks last!

FREE shipping for all purchases.

|

|

|

Follow us for latest updates!

Click here to unsubscribe to this newsletter.

|

|

|